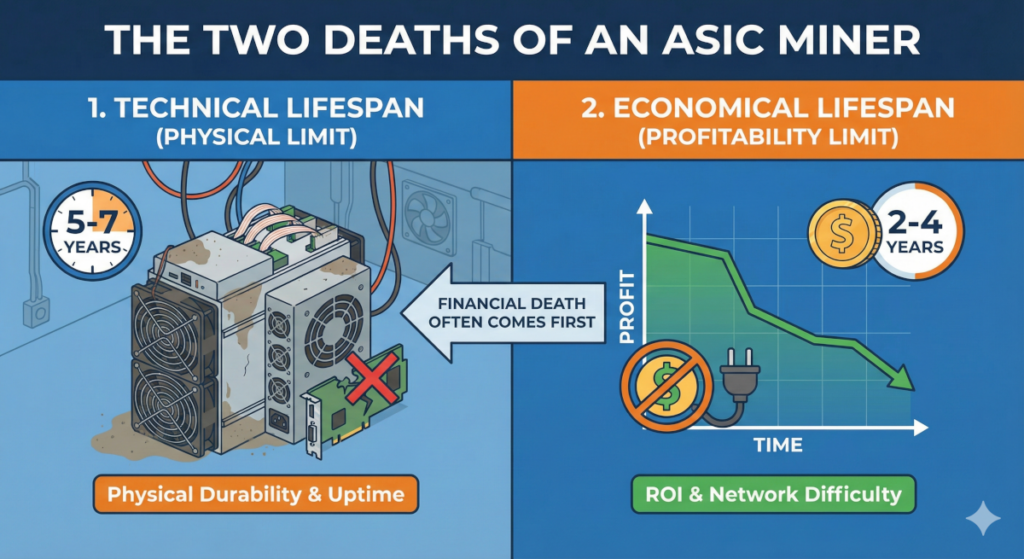

In the world of Bitcoin mining, your hardware has two different “deaths.” One is physical, and the other is financial. Understanding the gap between the technical lifespan and the economic lifespan is the difference between a profitable venture and a costly mistake.

1. Technical Lifespan: The “Physical” Limit

The technical lifespan is how long an ASIC (Application-Specific Integrated Circuit) miner can physically function before its parts fail.

Modern ASIC miners are industrial-grade machines. With proper care, a high-quality unit like a Bitmain Antminer S21 or MicroBT Whatsminer can physically run for 5 to 7 years, or even longer.

Key factors affecting technical life:

- Heat Management: Keeping chips under 75°C (167°F) prevents “silicon degradation.”

- Air Quality: Dust and humidity can cause short circuits or corrosion on hashboards.

- Power Stability: Using high-quality Power Supply Units (PSUs) protects sensitive chips from voltage spikes.

2. Economic Lifespan: The “Profitability” Limit

The economic lifespan is how long the miner generates more in Bitcoin than it costs to run (electricity and maintenance). For most miners, this is the only lifespan that matters.

In a competitive market, a miner usually becomes “economically dead” long before it physically breaks. This often happens within 2 to 4 years.

The “Death Sentence” for a Miner:

- Network Difficulty: As newer, more powerful miners join the network, your old machine’s share of the global hashrate shrinks.

- The Halving: Every four years, the Bitcoin block reward is cut in half, instantly doubling your production cost per BTC.

- Efficiency (J/TH): Newer miners use less electricity to produce the same hashrate. If your electricity costs $0.06/kWh, an older machine might spend $1.10 to mine $1.00 of Bitcoin, while a new machine spends $0.40.

Comparison Table: Technical vs. Economic

| Feature | Technical Lifespan | Economic Lifespan |

|---|---|---|

| Focus | Hardware durability and “uptime.” | Profitability and “ROI.” |

| Duration | 5 – 7 years (average). | 2 – 4 years (average). |

| Ended by… | Component failure (fans, chips). | Rising difficulty or low BTC price. |

| Main Goal | Keep the machine clean and cool. | Keep electricity costs low. |

| Value | Residual parts or scrap metal. | Resale value to miners with “free” power. |

Why This Matters for Your Strategy

If you assume your miner will make money for 7 years because the manufacturer says it “lasts” that long, your ROI calculations will be wrong.

Successful operators plan for a 3-year cycle. They aim to pay off the hardware (CapEx) within 12–18 months, then enjoy pure profit until the machine’s efficiency can no longer compete with the rising network difficulty. At that point, the “technical survivor” is often sold to someone with ultra-cheap electricity (under $0.03/kWh) who can still squeeze a few dollars out of it.

Pro Tip: In 2026, the gap is narrowing. As chip technology hits physical limits, new miners aren’t getting “twice as fast” every year anymore. This means your economic lifespan might actually get longer because your “old” hardware stays competitive for more time.